Respected Readers,

Today I tell you a PSU stock that has 20+ Subsidiaries and the stock has enough potential to become a future multi-bagger if the value of subsidiaries is unlocked.

1. Power Finance Corporation or PFC is a 10 rupee face value public sector maharatna company

2. Book Value of the Power Finance Corporation is 207.06 so at the Current price of 121.50, PFC is a value buy.

3. PFC Net Sale par share is 142.97 which is higher than the current market price.

4. If you are a new reader and have not familiar with my research terms then please first visit this link for research terms:- Mahesh Kaushik Research Terms.

5. Power Finance Corporation included in Nifty Financial Sector Index and Nifty Financial Sector Index P/E is 22.92 but PFC traded at 3.20 P/E which is near about 7 times lower than index P/E.That's Great!

6. Base price of the PFC is 112.74, So CMP is near 5% higher than the base price.

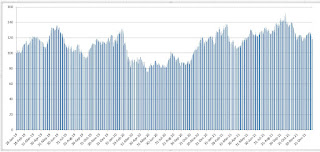

7. For Base price calculation download the last 3 years price history and graph from this link:-

|

| 3 Year Price Data and Graph |

8. पीएफसी/पीएफसी कंसल्टिंग की सहायक कंपनियों की वार्षिक रिपोर्टें

9. In 2021 PFC give a total of 14.75 rupees per share dividend which is nice and able to cover the interest rate.10. In Point no 8 You may notice PFC has many subsidiaries companies. when the value of these subsidiaries unlocks then you may assume what is the future valuation of this PSU Mataratna Company.

11. Year high=153.75 Year low =104.10 So year high/ low ratio is below 2.

12. I recommended buying it with my STP method and the STP price for 1 Feb 2022 to 15 Feb 2022 is 128.15, In the STP method buy our target is 25% plus.

13. For more details of the STP method watch this video:-https://youtu.be/gREpTaV50bA

14. Link of my Earlier STP recommendations:-

https://docs.google.com/spreadsheets/d/1ZWtF5z718RkLoz7QMIwtsOa4oXpP0dnHCVOlcSqFyaQ/edit?usp=sharing

15. Link of my books:- https://amzn.to/3IRNRHo

16. Disclaimer:- This is not an advisory service to buy or sell. The contents of “this research report” are only for educational purposes. No liability is accepted for any content in “this research report”. The author is neither a registered stockbroker nor a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity, index, or any other financial instrument at any time. The author recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions. Please read the full disclaimer at the bottom of my blog.

17. Discloser:- I Mahesh Chander Kaushik author of this research report is an existing research analyst and passed NISM certification for research analysts. I have also registered under SEBI(RESEARCH ANALYSTS) REGULATIONS, 2014 ( SEBI Registration Number INH 100000908 ) hereby disclose my financial interest in the subject company and the nature of such financial interest:- 1 Me and my associates or relatives have not to hold any share of PFC so my personal interest is not included in this stock. 2. Me and my associates or relatives have not any actual/beneficial ownership of one percent or more securities of the subject company (PFC ). 3. Me and my associates or relatives have not any other material conflict of interest at the time of publication of the research report. 4. Me and my associates and relatives have not received any type of compensation from the subject company(PFC) in the past twelve months. 5. I am not served as an officer, director, or employee of the subject company ( PFC ). 6. I have been not engaged in the market-making activity for the subject company (PFC).

Nice pick sirji

ReplyDeleteSirji pfc 14.75 rs dividend diya hai previous high 128.3

Sir Thank you for correction

Deletedont rely on him few years back i follow his recommendation and end in losses

ReplyDeleteDevil ji recommendations vivek se follow karni hai and STP method hi use karna hai aap dil se soche aapne kanhi na kanhi rule tode honge

DeleteJaankar dukh hua apke nuksaan k bare me, lekin me aise hazaro examples dekh chuka hun jinhone Mahesh sir ki strategies follow karke achi khasi disciplined earning ki hai.

DeleteAap apne investment ko check kijiye, kahin na khain galti hui hogi

Thank you Krishna ji... Sabse jyada followers ek hi rule todte hai ki vo apni capital ka 1/33 ek share me na lagakar lalach karte hai and share me jyada amount dalte hai..yadi ek share me 1/33 part of money se jyada kisi bhi halat me nahi dalne ka dhyan rahe to jyada se jyada kya hoga 1/33 part dub sakta hai Regards

DeleteDevilz jyada lalach buri Bala hai,mujhe to aajtak Mahesh sir ki bajah se koi loss nhi hua,Main to jab se sir ko follow kar raha hu profit me hu.

DeleteJi sir I will check

ReplyDeletePanditji dhanyawaad... 👃

ReplyDeleteThank you Surajit Chakaborty ji

DeleteThaNkyou sir, you are also a gem sir. Regards

ReplyDeleteThank you Sachin Gupta ji

DeleteSirji you are an honest person, thoughtful, never misguides, just like a family member who guides you from the bottom of the heart.

ReplyDeleteJai Hind Guruji. Every time you recommend gem share really you are a true mentor. I really salute your honesty.

ReplyDeleteSir, few years ago u strongely recommended country club , but usme sabka nuksan hi hua ya fir Paisa nhi bana

ReplyDeleteThank you sir

ReplyDeleteI agree with a lot of the points you made in this article. If you are looking for the inventory tracking app, then visit AdvStock Inventories. I appreciate the work you have put into this and hope you continue writing on this subject.

ReplyDelete𝑰𝒏𝒅𝒊𝒂'𝒔 𝒃𝒆𝒔𝒕 𝒕𝒆𝒍𝒆𝒈𝒓𝒂𝒎 𝒄𝒉𝒂𝒏𝒏𝒆𝒍 𝒇𝒐𝒓 𝑩𝒂𝒏𝒌𝒏𝒊𝒇𝒕𝒚 𝒄𝒂𝒍𝒍𝒔. 𝑾𝒆 𝒑𝒓𝒐𝒗𝒊𝒅𝒆 𝒅𝒂𝒊𝒍𝒚 𝑰𝒏𝒕𝒓𝒂𝒅𝒂𝒚 𝒄𝒂𝒍𝒍𝒔 👑👑💴💴

ReplyDelete𝑪𝒍𝒊𝒄𝒌 𝑯𝒆𝒓𝒆 𝑭𝒐𝒓 𝑱𝒐𝒊𝒏 - Big Bull Stocks

Hey, Really it was an great article to read, Waiting for another one till that get more information about ,Keep it up! Open New Bank Account

ReplyDeleteThank you sir

ReplyDelete